31+ fed mortgage backed securities

Web By the numbers. Cash value of agreements.

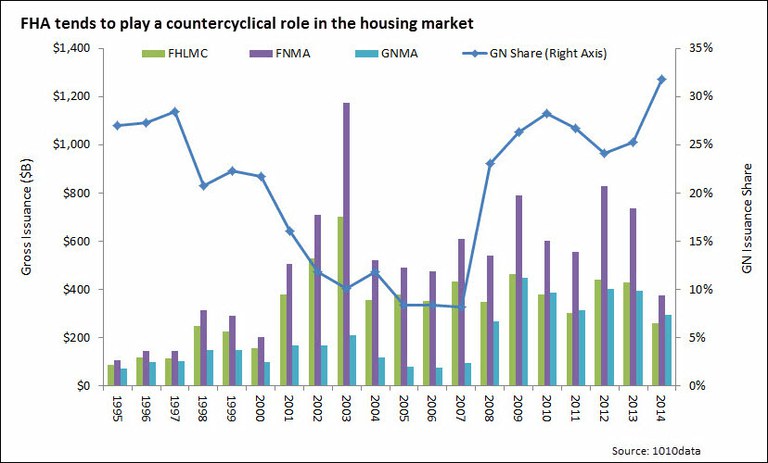

Agency Mbs Post Crisis Market Themes

Web WASHINGTON Jan 23 Reuters - Kansas City Federal Reserve President Esther George has urged her colleagues to come to terms earlier than later on a plan.

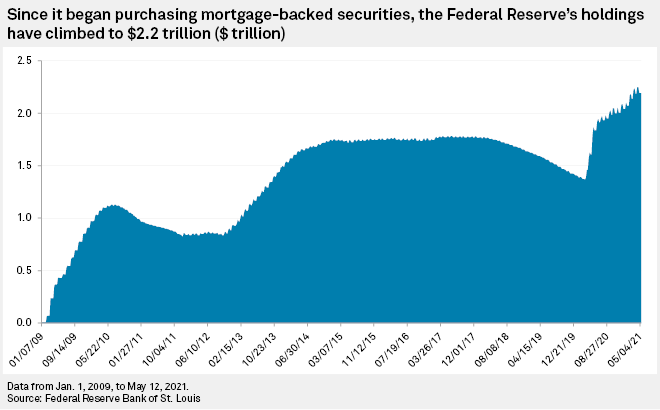

. An MBS is an asset-backed security that is. Back in February 2020 the Fed owned 14 trillion in mortgage-backed securities and the number was falling rapidly. Web How the Feds Policy Shift Is Rippling Through the Housing Market The central bank had been the biggest buyer of mortgage bonds but now it is stepping back.

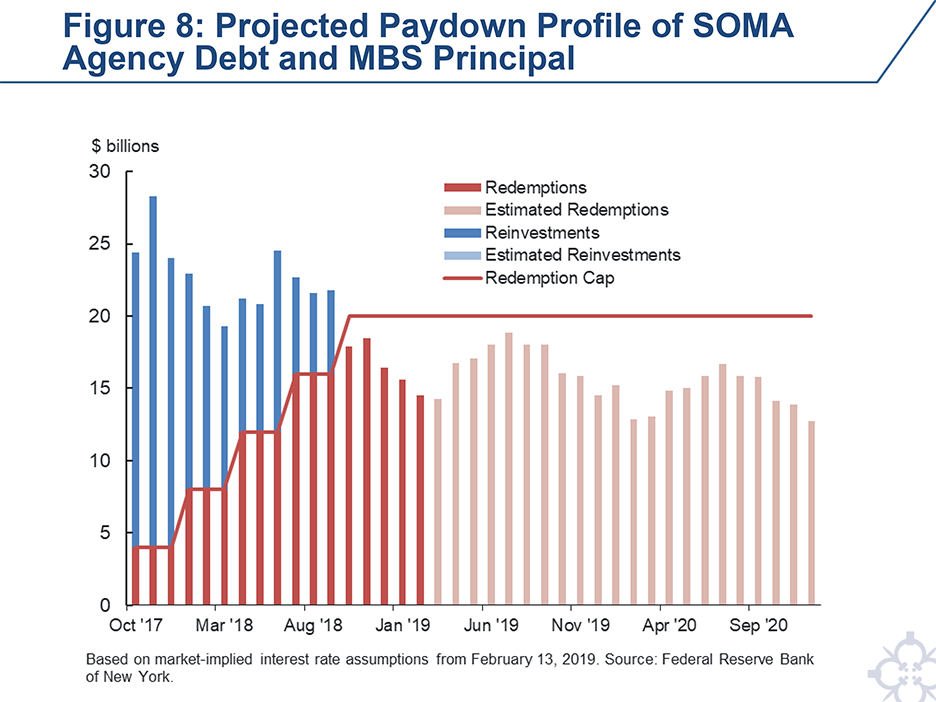

In the latest minutes from its March meeting the US. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Treasury securities Federal agency debt securities and mortgage-backed securities amortization is on an effective-interest basis.

Web Statement Regarding Treasury Securities and Agency Mortgage-Backed Securities Operations January 26 2022 On January 26 2022 the Federal Open Market Committee FOMC decided to continue to reduce the monthly pace of its net asset purchases in the purchase period beginning in mid-February bringing them to an end in. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages. Utilize a Transparent Service to Serve Your Securities Finance Needs.

Includes residential and commercial mortgage-backed securities. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them. Treasury - not those backed by home mortgages.

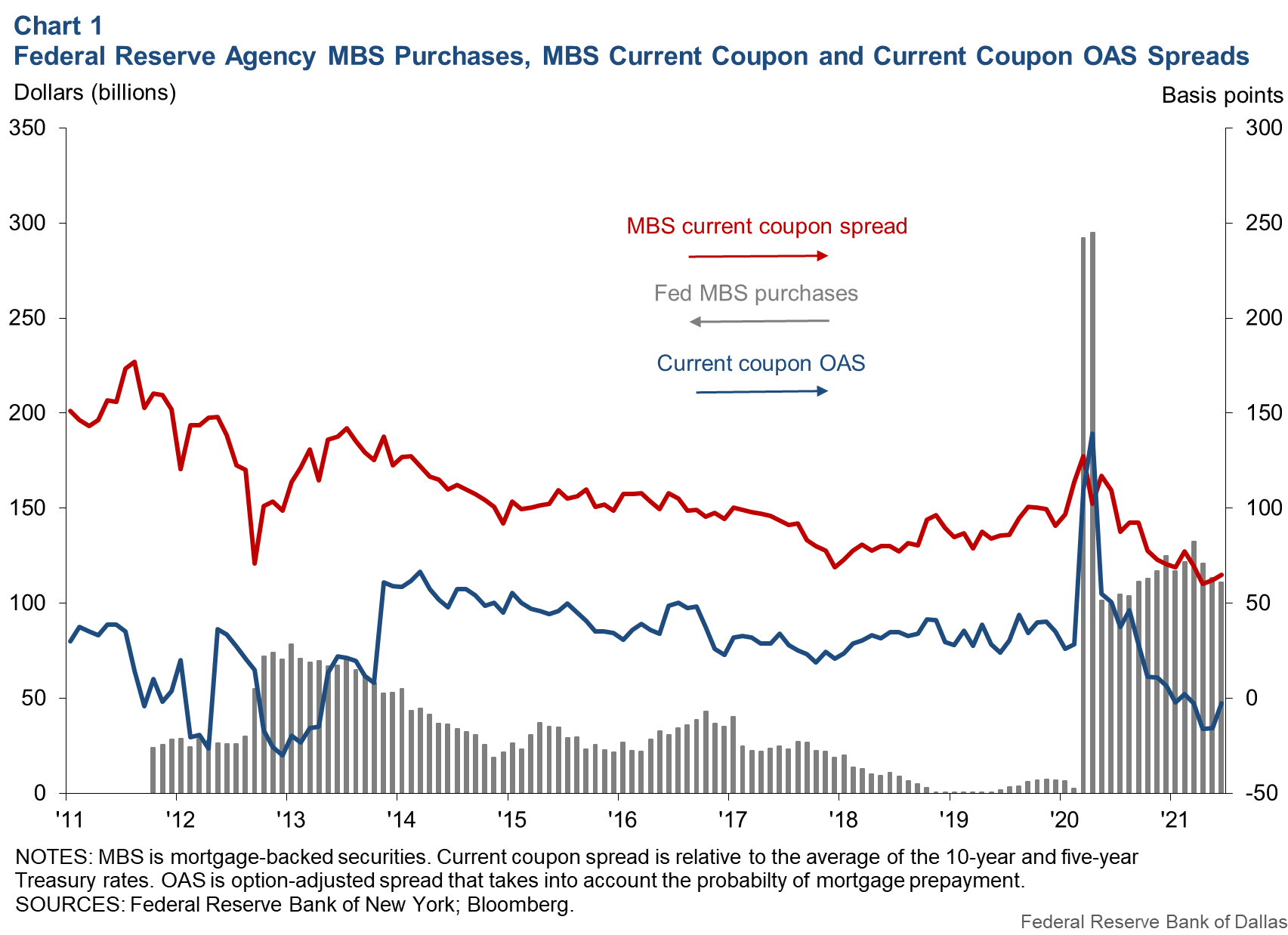

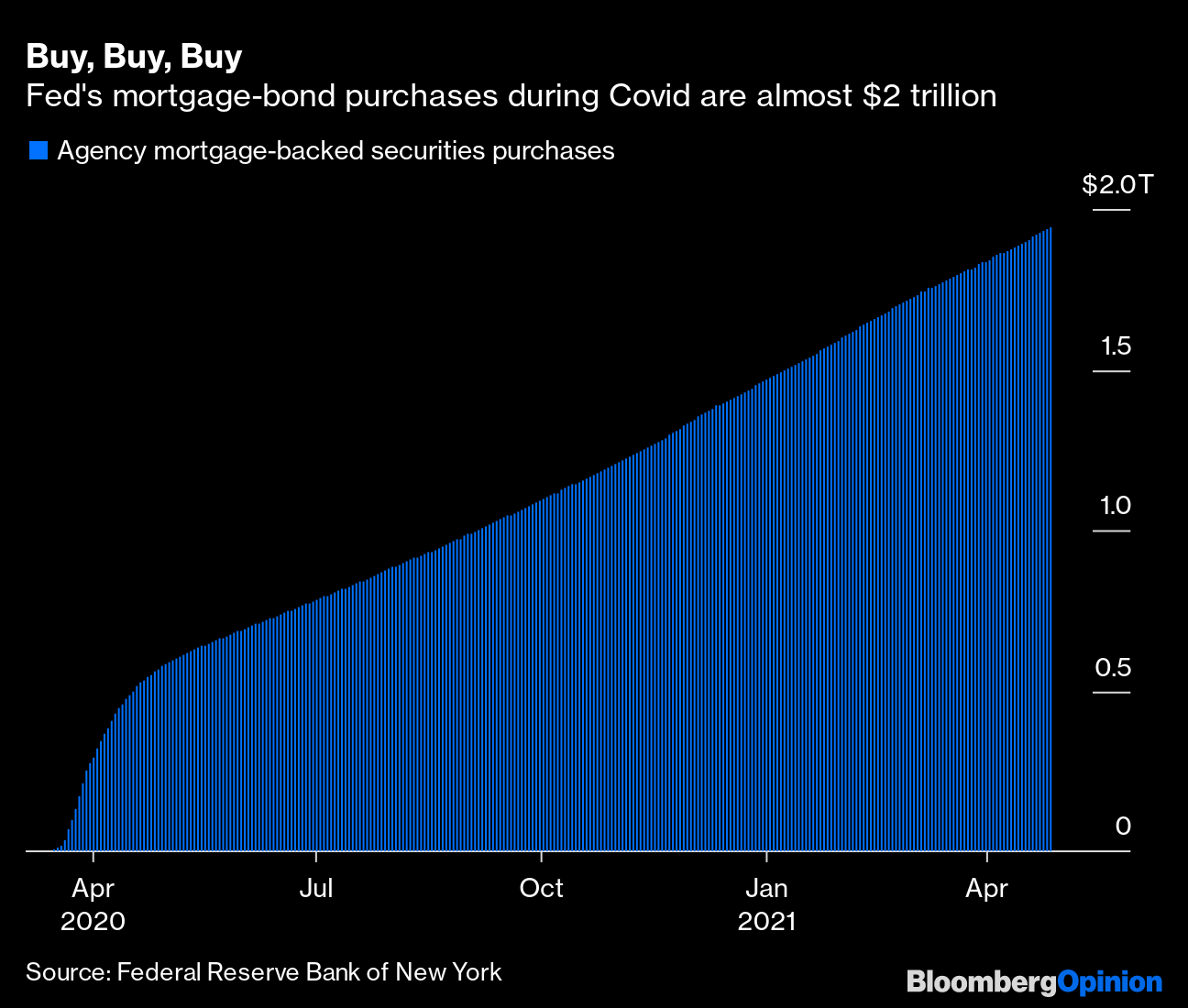

Web A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that issued them. Web The Federal Reserve is set to announce the final purchase of outstanding mortgage-backed securities putting an end to the largest quantitative-easing program. Web The Federal Reserves 125 trillion program to purchase agency mortgage-backed securities was intended to provide support to mortgage lending and housing markets.

Apply Get Pre-Approved Today. Web With the target federal funds rate at the effective lower bound the FOMC sought to provide additional policy stimulus by expanding the holdings of longer term. Web Why it matters.

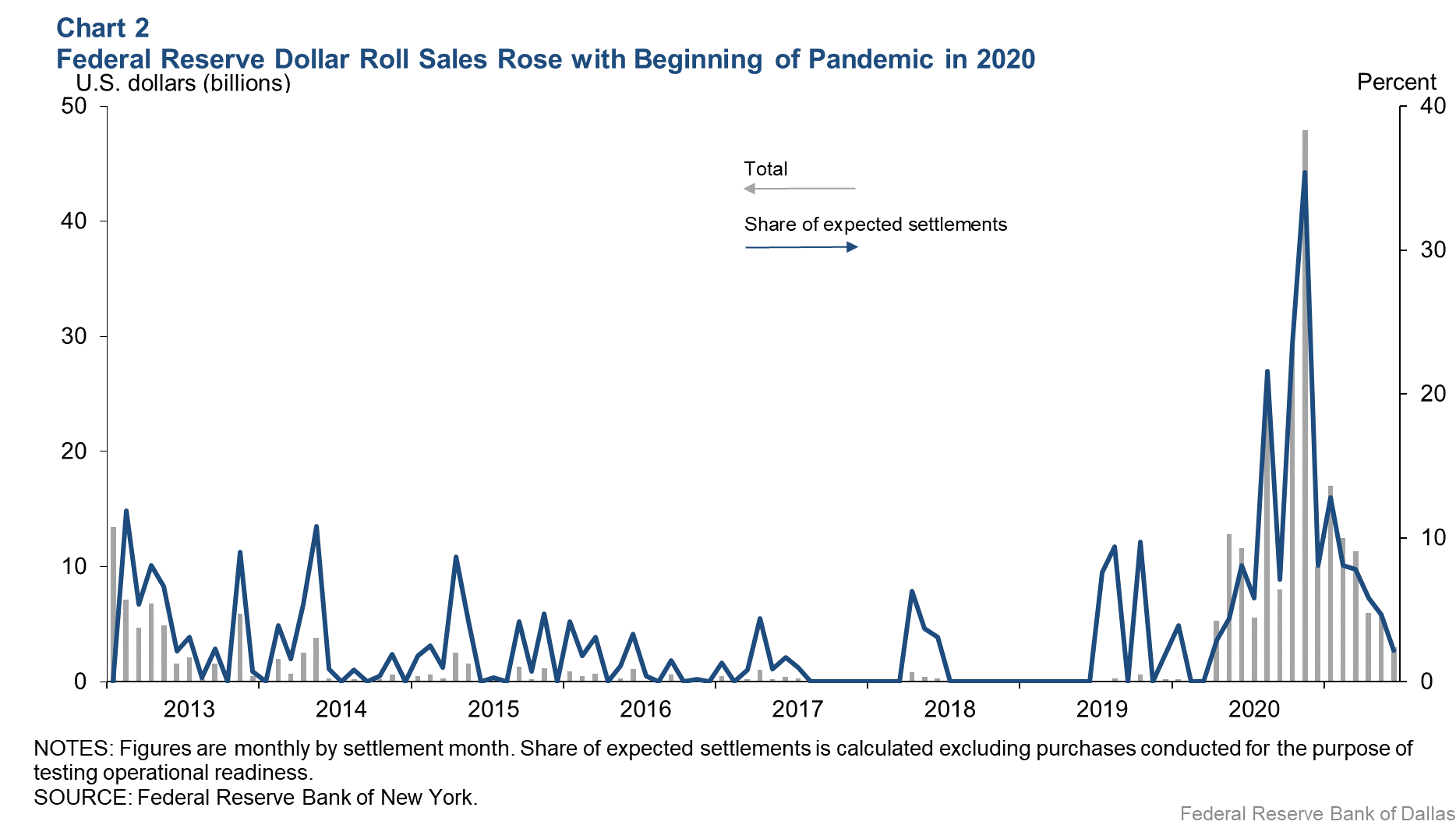

The Fed has been purchasing 40 billion worth of mortgage-backed securities MBS each month in an effort to keep interest rates steady and bond. Federal Reserve gave the capital markets a sneak peek of how its going to. Web The Federal Reserve quickly responded to significant financial market disruption at the onset of the COVID-19 pandemic in March 2020 providing stability in a.

Ad Learn More About How Fidelity Can Help You With Your Securities Finance Needs. Get Instantly Matched With Your Ideal Mortgage Lender. Web The interest rate on a 30-year fixed-rate mortgage has risen 22 percentage points since the start of the year MBA data shows and at 553 in the latest week is now at its highest level since 2009.

Residential mortgage-backed securities generally settle within 180. Until the 1980s nearly all US mortgages were held on. Includes assets purchased pursuant to terms of the credit facility and amounts related to Treasury contributions to the facility.

Web April 08 2022 1220 am EDT. Web The mortgage-backed securities MBS market emerged as a way to decouple mortgage lending from mortgage investing. Refer to note on consolidation below.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Low mortgage rates have spurred a boom in home refinancing which in turn has spurred a boom in the issuance of mortgage. Web The Fed is gobbling them up.

Lock Your Rate Today. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Compare the Best House Loans for March 2023.

Web She noted that Fed officials agree in principle that the central banks securities portfolio should only include those assets issued by the US. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web Mortgage-backed securities MBS are investment products similar to bonds.

Dncsra Htm

Will The Fed Really Sell Its Mortgage Bonds Next Year Financial Times

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

Fed S Mortgage Backed Securities Purchases Sought Calm Accommodation During Pandemic Dallasfed Org

Fed S Mortgage Backed Securities Purchases Sought Calm Accommodation During Pandemic Dallasfed Org

The Fed Has Missed The Balance Sheet Mortgage Back Security Reduction Target Reduction Every Single Month Schiffgold

The Fed Should Get Out Of The Mortgage Market Bloomberg

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

Federal Reserve Purchases Stabilize Agency Mbs Penn Mutual Asset Management

The Fed Stopped Buying Mbs Today Wolf Street

Dncsra Htm

Fed Sheds 38 Billion In Treasuries And Mbs In June Dumps Mbs At Record Pace Exceeding Cap For First Time Wolf Street

Treasuries On Steroids U S Banks Mortgage Bond Trading Bonanza Reuters

Dcorres Htm

Fed Mortgage Securities Purchases Draw Fire In White Hot Us Housing Market S P Global Market Intelligence

Demand For Agency Mbs In The Era Of The Fed Balance Sheet Unwind The Journal Of Structured Finance

Sober Look The Shrinking Mbs Market